How to Navigate Crypto Taxes in 2025: A Beginner’s Guide

If you’ve dipped your toes into cryptocurrency—whether it’s buying Bitcoin, trading Ethereum, or staking a few altcoins—you might be wondering: “Do I owe taxes on this?” As of March 31, 2025, the answer is a resounding yes, and the rules are tighter than ever.

Crypto taxes can feel like a maze for beginners, but don’t worry—this guide is here to simplify it all. In “How to Navigate Crypto Taxes in 2025: A Beginner’s Guide,” we’ll walk you through why crypto taxes matter, how to calculate your obligations, and the best tools to stay compliant without breaking a sweat. Whether you’re in the U.S., UK, or beyond, this is your roadmap to mastering crypto taxes with confidence. Let’s get started!

Why Crypto Taxes Matter in 2025

Crypto isn’t just a digital playground anymore—it’s a taxable asset worldwide, and 2025 is a pivotal year. Governments are cracking down, with the IRS in the U.S., HMRC in the UK, and others rolling out stricter reporting rules. Why should you care about how to navigate crypto taxes in 2025? Here’s the deal:

- Rising Adoption: Over 400 million people globally own crypto, per recent estimates, and tax agencies want their cut.

- New Regulations: The U.S. introduced Form 1099-DA for digital assets in 2025, while the EU’s MiCA framework is standardizing crypto tax rules.

- Penalties: Ignoring taxes can lead to audits, fines, or worse—especially if you’re trading big volumes.

For beginners, this might sound intimidating, but it’s manageable. Example: Imagine you bought $100 of Bitcoin in January 2025 and sold it for $150 in March. That $50 profit? It’s taxable. Understanding how to navigate crypto taxes in 2025 ensures you stay on the right side of the law—and keep more of your gains.

When Do You Owe Crypto Taxes? A Beginner’s Breakdown

Not every crypto move triggers a tax bill. Here’s a simple rundown of taxable events in 2025:

- Selling Crypto: Trading Bitcoin for cash or swapping it for Ethereum? That’s a capital gain (or loss).

- Spending Crypto: Bought a coffee with Dogecoin? It’s taxable based on its value when spent.

- Earning Crypto: Got paid in crypto for a gig or earned staking rewards? That’s income, taxed at your regular rate.

- Gifting or Donating: Small gifts might be exempt, but large ones can trigger taxes (e.g., U.S. gift tax over $18,000).

What’s not taxed? Buying crypto with cash and holding it—or transferring it between your own wallets. Knowing these triggers is step one in how to navigate crypto taxes in 2025.

Example: If you mined $200 of Ethereum in February 2025, that’s income. If you sold it for $250 in March, you’ve got a $50 capital gain. Both are reportable.

How to Calculate Crypto Gains and Losses in 2025

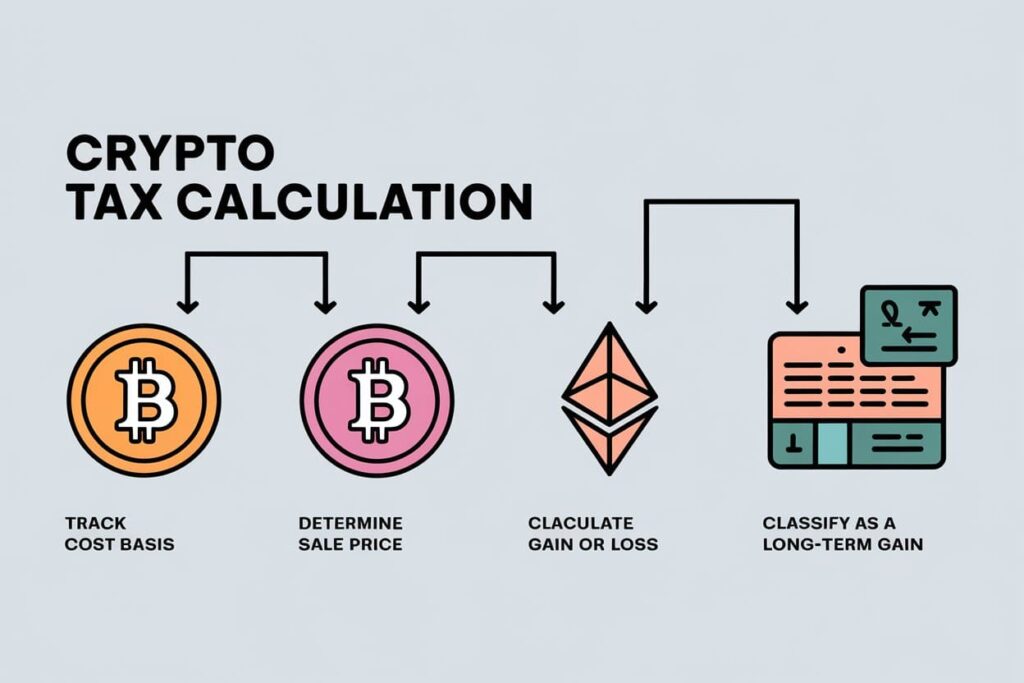

Calculating crypto taxes sounds complex, but it’s straightforward once you break it down. Here’s a beginner-friendly guide:

- Track Your Cost Basis: This is what you paid for the crypto, including fees.

- Example: Bought 1 BTC for $40,000? That’s your basis.

- Determine Sale Price: Sold that BTC for $45,000? That’s your proceeds.

- Calculate Gain or Loss: Subtract the basis from the proceeds.

- $45,000 – $40,000 = $5,000 gain.

- Classify the Gain:

- Held it less than a year? It’s a short-term gain, taxed like income (e.g., 10–37% in the U.S.).

- Held it over a year? It’s long-term, with lower rates (0–20%).

Example: You bought 0.5 ETH for $1,000 in January 2025 and swapped it for $1,200 of USDT in March. Your gain is $200, and since it’s short-term, it’s taxed at your income rate.

Step-by-Step: Reporting Crypto Taxes in 2025

Ready to file? Here’s a practical guide using the U.S. as an example (adjust for your country):

- Gather Records: Collect transaction history from exchanges (e.g., Coinbase, Binance) or wallets.

- Use Tax Software: Platforms like Koinly or TurboTax integrate with exchanges to tally gains/losses.

- Fill Out Forms:

- Report income on Form 1040, Schedule 1

- Capital gains on Form 8949, then transfer totals to Schedule D

- Form 1099-DA might apply if your exchange issues it.

- Double-Check: Missed trades can trigger IRS notices—verify everything.

- File by Deadline: April 15, 2025, for U.S. taxpayers (extensions to October available).

Non-U.S. readers: Check local rules—UK uses Self-Assessment, Canada has no crypto-specific form but taxes gains.

Top Crypto Tax Software for Beginners in 2025

Manually tracking hundreds of trades is a nightmare. Here are the best tools to simplify how to navigate crypto taxes in 2025:

- Koinly: Syncs with 300+ exchanges, calculates gains, and generates tax reports. Cost: $49–$179/year.

- CoinLedger: User-friendly, with free portfolio tracking and paid tax plans ($49+). Great for beginners.

- TurboTax Crypto: Integrates with U.S. filings, ideal if you already use TurboTax ($69+).

- TaxBit: Offers free basic reports, with premium plans for complex portfolios ($50+).

Common Crypto Tax Mistakes Beginners Should Avoid

Even with tools, pitfalls lurk. Here’s what to avoid:

- Ignoring Small Transactions: That $10 NFT sale? Still taxable.

- Mixing Cost Basis Methods: Stick to FIFO (First In, First Out) or check local rules—switching mid-year confuses things.

- Forgetting Airdrops: Free tokens from a 2025 promo? Taxed as income at fair market value.

- Missing Deadlines: Late filings mean penalties—mark your calendar!

Benefits of Getting Crypto Taxes Right in 2025

Why bother with how to navigate crypto taxes in 2025? Beyond avoiding trouble, there’s upside:

- Peace of Mind: Compliance keeps audits at bay.

- Maximize Deductions: Losses can offset gains, lowering your tax bill.

- Build Wealth: Reinvest profits without legal headaches.

Take Control of Your Crypto Taxes Today

As of March 31, 2025, crypto taxes don’t have to be a mystery. With this guide, you’ve got the tools to track, calculate, and report like a seasoned investor—all while keeping it simple.

Start by gathering your trades, pick a tool like Koinly, and file with confidence. Crypto’s future is bright—don’t let taxes dim it.

My Another Blog on: Top 5 Dividend Stocks for Beginners in 2025 USA

Got questions or a favorite tax tip? Drop it in the comments—I’d love to hear from you!