How to Build a Passive Income Portfolio in 2025 with Just $500

Dreaming of financial freedom in 2025 but think you need thousands to start? Think again! With just $500, you can begin building a passive income portfolio in 2025 that grows over time. Whether you’re a beginner or looking to diversify, this guide will show you how to turn a modest investment into a steady income stream using simple, proven strategies. Let’s explore how to make your money work for you this year!

Why Start a Passive Income Portfolio in 2025?

The year 2025 is shaping up to be a prime time for passive income. With economic shifts—like cooling inflation and stable interest rates as of March 4, 2025—small investors have a golden opportunity to build wealth. A passive income portfolio in 2025 offers:

- Steady Cash Flow: Earn money without constant effort.

- Low Entry Barrier: $500 is enough to get started with the right tools.

- Long-Term Growth: Compound your returns over time.

Ready to see how? Let’s break it down.

Step-by-Step Guide to Build a Passive Income Portfolio in 2025 with $500

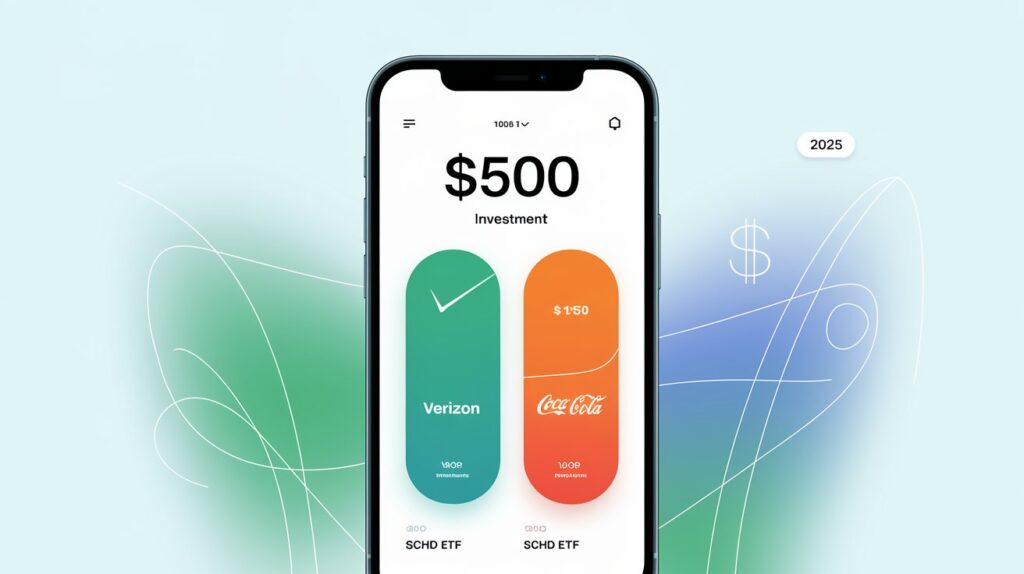

Here’s how to create your passive income portfolio in 2025 with just $500, using beginner-friendly options like dividend stocks and ETFs.

Step 1: Choose the Right Investment Vehicles

Focus on assets that pay you regularly, such as:

- Dividend Stocks: Reliable companies like Coca-Cola (KO) or Verizon (VZ) from our Top 5 Dividend Stocks for Beginners in 2025 USA list offer yields of 3-6%.

- Dividend ETFs: Funds like the Schwab U.S. Dividend Equity ETF (SCHD) provide diversification with a ~3.5% yield.

With $500, you can split your funds—say, $250 in stocks and $250 in an ETF—for balance.

Step 2: Pick a Beginner-Friendly App

Use one of these apps from our previous guide to start investing:

- Robinhood: Buy fractional shares of Verizon for as little as $10.

- Fidelity: Access SCHD with no fees and set up a DRIP.

- SoFi Invest: Start with $1 and track your passive income portfolio in 2025.

- Acorns: Automate small investments with round-ups.

Download one today and fund your account with $500.

Step 3: Allocate Your $500 Wisely

Here’s a sample allocation for your passive income portfolio in 2025:

- $150 – Verizon (VZ): ~6% yield = $9/year.

- $150 – Coca-Cola (KO): ~3% yield = $4.50/year.

- $200 – SCHD ETF: ~3.5% yield = $7/year.

Total annual passive income: ~$20.50. It’s small, but reinvesting these dividends will grow your portfolio over time.

Step 4: Reinvest Dividends for Growth

Set up a Dividend Reinvestment Plan (DRIP) through Fidelity or Robinhood. For example, Verizon’s $9 in dividends can buy more shares, compounding your income. In 2025, this strategy turns your passive income portfolio in 2025 into a snowball of wealth.

Step 5: Monitor and Scale

Check your portfolio monthly via your app. Add $50-$100 whenever possible to accelerate growth. By year-end, your $500 could generate $25-$30 annually—and that’s just the start!

Benefits of a $500 Passive Income Portfolio in 2025

Investing $500 in a passive income portfolio in 2025 offers:

- Affordability: No need for a big budget to begin.

- Learning Opportunity: Practice investing with low risk.

- Scalability: Small wins build confidence to invest more.

- Stability: Dividend payers like Coca-Cola thrive in uncertain markets.

Common Mistakes to Avoid with Your Passive Income Portfolio in 2025

Newbies often stumble—here’s how to stay on track:

- Chasing High Yields: A 10% yield might signal risk; stick to stable picks like Verizon.

- Ignoring Fees: Use no-fee apps like SoFi to maximize returns.

- Impatience: Passive income grows slowly—don’t sell early.

Your passive income portfolio in 2025 thrives with patience and consistency.

Your $500 Passive Income Journey Starts Now

Building a passive income portfolio in 2025 with just $500 is not only possible—it’s a smart move for beginners. By choosing solid dividend stocks or ETFs, using apps like Fidelity or Robinhood, and reinvesting your earnings, you’ll set the foundation for financial freedom. Start today, March 4, 2025, and watch your $500 grow into a reliable income stream. What’s your first investment pick? Share in the comments!