Top 5 Fractional Real Estate Apps for Newbies in 2025 – Fractional Investing 2025 Guide

What Makes Fractional Investing 2025 a Game-Changer for Newbies?

Fractional real estate is like buying a share of a stock, but it’s a house, apartment, or office instead. You pool cash with others to own a piece, earning rent or growth profits without the hassle of full ownership. Why’s fractional investing 2025 blowing up? Apps are slashing minimums—$10 gets you in—and the US market’s ripe, with home prices up 4.5% (Zillow 2025 forecast). For newbies, it’s low-risk, low-cost, and educational—perfect if you’re a teen or just dipping your toes. Big sites talk stocks all day, but fractional real estate? That’s where beginners like us can shine. Let’s meet the apps that make it happen.

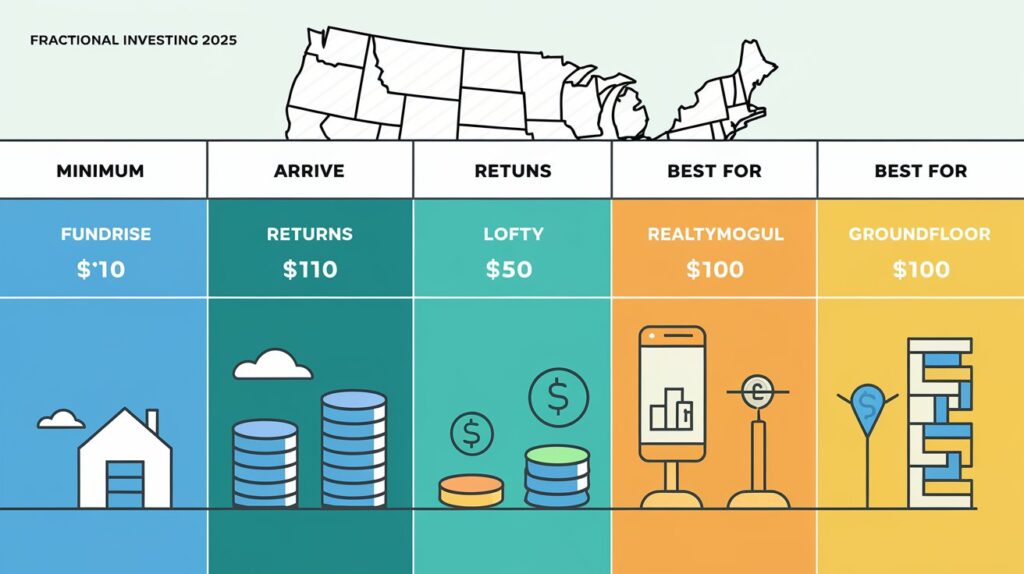

Top 5 Apps for Fractional Investing 2025 – Detailed Breakdown

Here’s my deep dive into the top 5 fractional real estate apps for newbies in 2025. Each one’s beginner-friendly, affordable, and built for small starts—I’ve ranked them based on ease, cost, and growth potential.

1. Fundrise – The Diversified Starter

- What It Is: Fundrise pools your money into eREITs (real estate investment trusts), spreading it across dozens of US properties—think rentals, condos, and commercial spaces.

- Minimum: $10 (Starter plan)—$100 gets you a solid chunk.

- Cost: $0 upfront, 1% annual fee (billed monthly).

- Returns: 7-12% historically (Fundrise data, 2024)—$100 could hit $107-$112 in a year.

- Why Newbies Love It: No picking properties, just invest and chill. Teens with $10 can start, and the app’s slick dashboard explains everything.

- Downside: Locked in 1-5 years—plan to hold.

- My Take: I’d have picked this over my ₹8000 flop—diversified, low-stress, and newbie-proof.

2. Arrived – The Pick-Your-Home Option

- What It Is: Arrived lets you buy shares in specific rental homes—like a cozy Atlanta bungalow or a Nashville condo.

- Minimum: $100 per property.

- Cost: No fees to invest, 1% annual management fee.

- Returns: 4-8% from rent + appreciation (Arrived 2024 avg.)—$100 might grow to $106-$108 yearly.

- Why Newbies Love It: Choose your house—feels personal! Teens with $100 get a real stake, and it’s simple to track.

- Downside: Higher entry than Fundrise, less diversification.

- My Take: Cool if you like control—$100 feels like “your” property.

3. Lofty – The Daily Payout Gem

- What It Is: Lofty offers fractional shares in rentals with rent paid daily—yes, daily!—via blockchain tokens.

- Minimum: $50 per property—$100 buys two shares.

- Cost: No signup fees, 1-2% annual cut from profits.

- Returns: 6-10% annualized (Lofty 2024 stats)—$100 could hit $106-$110 in a year, plus daily drips.

- Why Newbies Love It: Daily cash keeps it exciting—great for teens watching pennies grow. Mobile-first app’s a breeze.

- Downside: Blockchain might confuse total newbies—stick to basics.

- My Take: That daily payout? I’d be hooked—small wins add up fast!

4. RealtyMogul – The Step-Up Choice

- What It Is: RealtyMogul offers REITs and single properties—more options than Fundrise, less hands-on than Arrived.

- Minimum: $100 for REITs (individual deals often $5k+).

- Cost: 1-1.25% annual fee, no upfront costs.

- Returns: 6-9% historical (RealtyMogul 2024)—$100 might reach $106-$109 yearly.

- Why Newbies Love It: $100 gets you diversified REITs—safe and steady. Teens can scale later to bigger deals.

- Downside: Less flashy app, steeper learning curve.

- My Take: Solid middle ground—grow $100 now, aim bigger later.

5. Groundfloor – The Short-Term Play

- What It Is: Groundfloor funds real estate loans (fix-and-flips), paying you back with interest in 6-12 months.

- Minimum: $10 per loan—$100 spreads across 10.

- Cost: Free to invest, no fees.

- Returns: 8-12% annualized (Groundfloor 2024)—$100 could hit $108-$112 fast.

- Why Newbies Love It: Quick cash, low entry—teens can test $10 chunks. No lock-ins like others.

- Downside: Riskier—loans can default (though rare).

- My Take: I’d try $100 here for speed—feels like a hustle win!

Why Fractional Investing 2025 Is Perfect for Newbies

In 2025, fractional investing 2025 is a newbie’s dream. US real estate’s climbing (4.5% growth, per Zillow), and apps are slashing barriers—$10-$100 minimums beat the old $100k buy-in. Arrived’s user base jumped 30% under-25s in 2024, and Fundrise hit $3 billion managed—proof teens and beginners are all in. Inflation’s at 3% (Fed estimate), so cash rots while property grows. I wasted ₹8000 on hosting—fractional real estate would’ve been my move. Start now, and you’re ahead of the pack!

How to Pick the Best Fractional Investing 2025 App for You Confused?

Here’s how to choose:

- Low Budget ($10-$50): Fundrise or Groundfloor—start tiny, grow steady.

- Hands-On ($100): Arrived—pick your house, feel the vibe.

- Daily Cash: Lofty—watch it drip, stay motivated.

- Set-and-Forget: RealtyMogul—safe, simple REITs.

- Quick Wins: Groundfloor—cash out fast, reinvest. I’d mix Fundrise ($50) and Lofty ($50) with $100—diverse and fun. Teens, grab a parent for custodial setup—then you’re golden.

My Last Final Thoughts

The top 5 fractional real estate apps for newbies in 2025—Fundrise, Arrived, Lofty, RealtyMogul, and Groundfloor—prove fractional investing 2025 is your ticket to real estate without millions. Start with $10-$100, pick your app, and grow small moves into big wins. At MoneyBitx.com, I’m breaking down money hacks like this—check my last post on owning real estate for $100! Which app’s your vibe? Hit me on X—I’d love to hear your first investment step!

Also Visit My New Article Based On This : Fractional Real Estate USA Beginners Guide